How Paul B Insurance can Save You Time, Stress, and Money.

Wiki Article

The Of Paul B Insurance

Table of ContentsSome Known Details About Paul B Insurance How Paul B Insurance can Save You Time, Stress, and Money.Our Paul B Insurance StatementsAn Unbiased View of Paul B InsuranceGetting The Paul B Insurance To WorkNot known Facts About Paul B InsuranceWhat Does Paul B Insurance Do?

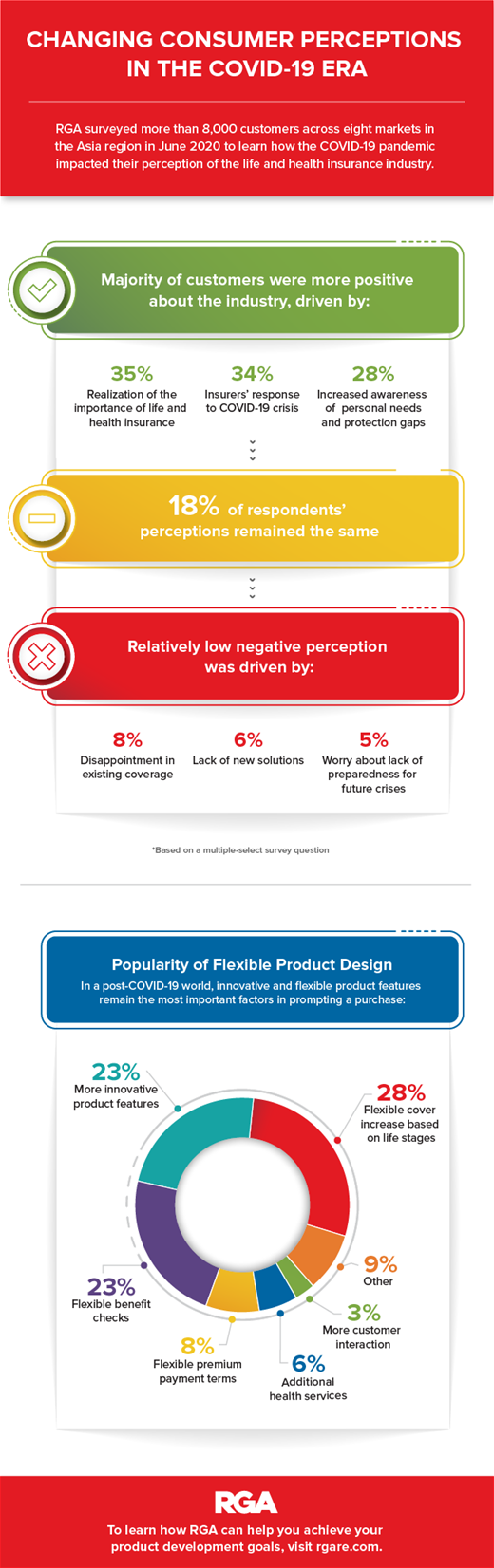

Regardless of how hard you try to make your life better, an unforeseen event can entirely turn points upside-down, leaving you literally, mentally as well as monetarily strained. Having ample insurance policy aids in the feeling that at the very least you do not need to consider money throughout such a tough time, and also can concentrate on recovery.

Such therapies at excellent health centers can cost lakhs. Having wellness insurance policy in this case, saves you the fears as well as stress and anxiety of arranging money. With insurance policy in position, any monetary tension will certainly be looked after, and also you can concentrate on your recovery. Having insurance life, wellness, and also obligation is a vital part of financial planning.

The Definitive Guide to Paul B Insurance

With Insurance compensating a big part of the losses services and families can recuperate instead easily. Insurance companies merge a big amount of money. Part of this cash can be spent to sustain investment activities by the government. As a result of the safety concerns insurers just spend in Gilts or government protections.

There are broadly 2 types of insurance coverage as well as allow us understand how either is relevant to you: Like any liable individual, you would certainly have intended for a comfy life basis your earnings as well as career projection. They also provide a life cover to the guaranteed. Term life insurance coverage is the pure form of life insurance coverage.

If you have some time to retire, a deferred annuity gives you time to invest for many years and also construct a corpus. You will certainly obtain income streams called "annuities" till the end of your life. Non-life insurance coverage is also described as general insurance and also covers any kind of insurance policy that is outside the purview of life insurance policy.

When it comes to non-life insurance policies, factors such as the age of the asset as well as deductible will certainly also affect your selection of insurance policy plan. Forever insurance strategies, your age and health and wellness will affect the costs expense of the plan. If you own a car, third-party insurance coverage is required before you can drive it when traveling.

The Basic Principles Of Paul B Insurance

Insurance coverage is a legal arrangement in between an insurance policy firm (insurance provider) as well as a private (insured). In this instance, the insurance policy company guarantees to make up the insured for any losses incurred due to the protected backup occurring.

The key functions of Insurance policy are: The key feature of insurance is to protect against the opportunity of loss. The time and quantity of loss are unforeseeable, and also if a danger takes place, the individual will certainly incur a loss if they do not have insurance. Insurance makes sure that a loss will be paid and consequently shields the guaranteed from suffering.

Paul B Insurance for Dummies

The treatment of figuring out premium rates is additionally based upon the policy's risks. Insurance gives repayment certainty in the event of a loss. Better preparation as well as administration can aid to reduce the danger of loss. In risk, there are different kind of unpredictability. Will the threat occur, when will it take place, and also just how much loss will there be? Simply put, the occurrence of time and the amount of loss are both unpredictable.There are website here a number of additional features of Insurance policy. These are as follows: When you have insurance coverage, you have ensured cash to pay for the treatment as you receive correct economic assistance. This is one of the vital secondary functions of insurance policy via which the public is shielded from ailments or mishaps.

The feature of insurance is to eliminate the stress and also suffering related to fatality and residential property damage. An individual can commit their body and heart to much better accomplishment in life. Insurance uses a motivation to strive to better individuals by protecting society against massive losses of damages, damage, and death.

Paul B Insurance - An Overview

There are a number of duties and relevance of insurance. Some of these have actually been provided below: Insurance cash is invested in many initiatives like water supply, power, as well as highways, contributing to the country's total financial success. Instead of concentrating on a solitary individual or organisation, the danger influences different individuals as well as organisations.Insurance policy policies can be utilized as security for credit score. When it comes to a home finance, having insurance policy protection can make getting the lending click to read more from the lending institution simpler.

25,000 Section 80D Individuals as well as their household plus moms and dads (Age less than 60 years) Amount to Rs. 50,000 (25,000+ check these guys out 25,000) Section 80D People as well as their household plus parents (Age greater than 60 years) Complete Up to Rs. 75,000 (25,000 +50,000) Section 80D People as well as their family members(Anybody above 60 years of age) plus parents (Age greater than 60 years) Amount to Rs.

Some Ideas on Paul B Insurance You Need To Know

All kinds of life insurance policies are readily available for tax exemption under the Revenue Tax Act. The benefit is received on the life insurance coverage policy, whole life insurance policy strategies, endowment strategies, money-back plans, term insurance coverage, and Device Linked Insurance Coverage Program.This arrangement likewise permits a maximum reduction of 1. 5 lakhs. Every person should take insurance for their wellness. You can select from the different kinds of insurance policy as per your demand. It is advised to have a health or life insurance policy policy considering that they prove beneficial in tough times.

Insurance policy promotes relocating of threat of loss from the guaranteed to the insurance provider. The standard concept of insurance coverage is to spread threat amongst a multitude of people. A huge populace obtains insurance plan and also pay costs to the insurer. Whenever a loss happens, it is made up out of corpus of funds gathered from the millions of insurance holders.

Report this wiki page